In a significant decision, the Reserve Bank of India chose to keep its benchmark repo rate steady for the fourth consecutive time, holding it at 6.5% during its latest announcement on Friday. The central bank emphasized its commitment to a policy of “withdrawal of accommodation” as a measure to rein in inflation.

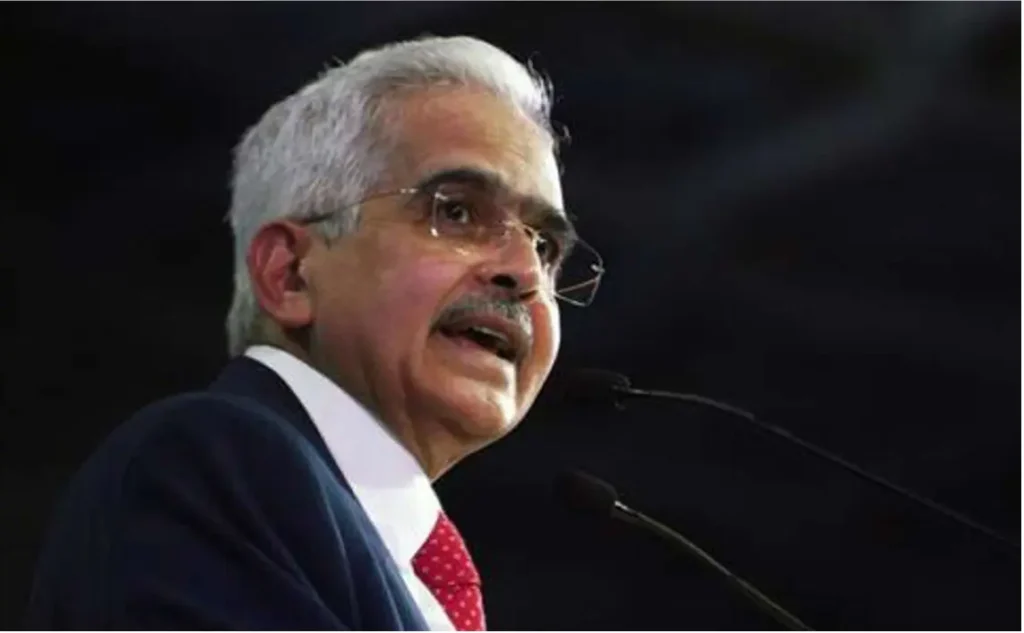

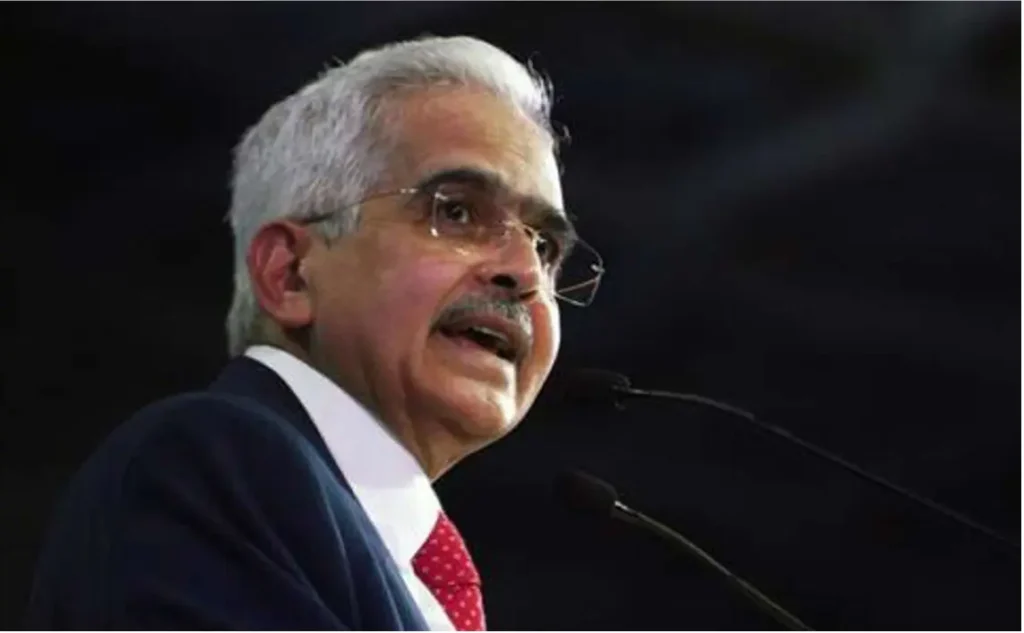

RBI Governor Shaktikanta Das, commenting on this decision, cautioned that persistent and substantial fluctuations in food prices could lead to a broader and sustained rise in overall inflation. He expressed vigilance regarding the possibility of elevated food prices affecting other sectors and creating stubborn inflationary pressures. Despite a positive outlook for core inflation (which excludes the volatile food and fuel prices), Das referred to the continuing threat of higher food prices due to uncertainties in the kharif or summer sowing and the ongoing global economic slowdown.

Governor Shaktikanta Das underscored that the central theme of the RBI’s monetary policy remained centered around the “withdrawal of accommodation.” This signifies the RBI’s commitment to managing money supply in the economy to control inflation.

Das also noted that vegetable prices had eased in August and were expected to decline further in September, with official figures to be released shortly. Additionally, the RBI projected a real GDP growth rate of 6.5% for India’s economy in the fiscal year 2023-24, with growth estimated at 6.5% for the July-September 2023 period, followed by 6% in October-December 2023 and 5.7% in January-March 2024.

Notably, high cereal prices and the potential impact of El Nino, a global weather pattern, remained key variables that could influence the trajectory of inflation.

It’s worth noting that the central bank had previously raised the repo rate by 250 basis points to 6.5% between May 2022 and February 2023. However, it opted to maintain this rate during its April review of the monetary policy. The repo rate refers to the interest rate at which commercial banks borrow funds from the Reserve Bank by selling their securities, while the reverse repo rate is the rate at which the central bank borrows money. These rates play a crucial role in stimulating credit and investments by businesses, with rate hikes serving to make borrowing more expensive for enterprises, thereby limiting the money supply and cooling inflation—consistent with the primary objective of raising benchmark rates by banks.